IPO Success of Le Merite Exports Limited

It all started in 2017, a quest for success culminating in an IPO and soon the Apr 25th, 2022, IPO opening for Le Merite Exports. On May 9th, 2022, we stood together to celebrate the people behind the successful IPO of Le Merite IPO with Tiare Consilium, who jointly put their heart & soul into building the IPO that changed the dynamics of India’s Textile industry.

Our IPO advisory services team has been an integral part of the end-to-end, “turn-key” solutions and strategies needed through the IPO process. From advising in the due diligence process of the company to advising in completing pre-issue secretarial compliance.

Introduction of “Le Merite Exports Limited”

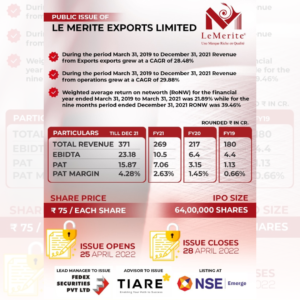

“Le Merite Exports Limited” are vertically integrated into the Manufacturing of Cotton Yarn & Greige Fabrics. “Le Merite” is a well-renowned & popular brand name in several yarn importing countries. LMEL have a long-standing customer relationship, exclusive tie-ups & agents in top importing countries of Cotton yarn & fabrics. Bangladesh, China, Turkey, Portugal, Egypt, South Korea, Iran, Italy, Vietnam, Thailand, Peru, UAE, USA to name a few.

LMEL is exporting to almost 37 countries. Our annual export revenue is more than INR 4000 million & we believe to achieve INR 10,000 Million within 2 years.

Tiare’s Financial Advisory aids businesses with IPO readiness by assisting in marketing tie-up with investors and helping in Issue Opening and Issue Closing. Our core team stands firm with the post-closure compliances and post-listing assistance too so that you can stay focused on your company and investors.

Preparing for the IPO

A well-managed IPO can be the start of great things for companies of any size. A good team is as important for an IPO as it is for due diligence. You’ll need efficient accountants, legal experts, underwriters and financial advisors specialising in IPOs before beginning the process.

Maximizing the value of the IPO

The equity story is the foundation of any successful IPO, as it provides a clear and understandable indication for your organization while serving as a compelling rationale for why investors should be interested. Investment bankers will rely on an equity story to determine both the marketability of the company and the valuation.

Structuring the IPO

Determining the significant structure for an IPO can provide valuable benefits. Regardless of the structure or process chosen, getting the right company or group structure in place is critical to driving value and efficiency.

With you in the Process

While the IPO is a months-long fiesta, it requires the company to put on eulogies, launch ad blitzes, do wall-to-wall paperwork, solve insurmountable problems, ceaseless number-crunching and endless legwork. To create a clear path forward, you need the confidence that comes from working with a team of straight-talking advisors and actionable insights from a team of dedicated professionals. We can guide you through each step of the readiness assessment process and beyond.